Why You May Want To Start Your Home Search Today

Why You May Want To Start Your Home Search Today If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyers may wait things out, there’s a reason serious buyers are making moves right now, and that’s the growing number of homes for sale. So far this year, housing inventory has been increasing and that’s making the prospect of finding your dream home less difficult. While there are always reasons you could delay making a big decision, there are also always reasons to consider moving forward. And having a growing number of options for your home search may be exactly what you needed to feel more confident in making a move. What’s Causing Housing Inventory To Grow? As new data comes out, we're getting an updated picture of why housing supply is increasing so much this year. As Bill McBride, Author of Calculated Risk, explains: “We are seeing a significant change in inventory, but no pickup in new listings. Most of the increase in inventory so far has been due to softer demand - likely because of higher mortgage rates.” Basically, the inventory growth is primarily from homes staying on the market a bit longer (known as active listings). And that’s happening because higher mortgage rates and home prices have helped moderate the peak frenzy of buyer demand. The graph below uses data from realtor.com to show how much active listings have risen over the past five months as a result (shown in green): Why This Growth Is Good News for You Regardless of the source, the increase in available housing supply is good for buyers. More housing supply actively for sale means you have more options as your search for your next home. A recent article from realtor.com explains just how significant the inventory growth has been and why it’s good news for your plans to buy: “Nationally, the inventory of homes actively for sale on a typical day in July increased by 30.7% over the past year, the largest increase in inventory in the data history and higher than last month’s growth rate of 18.7% which was itself record-breaking. This amounted to 176,000 more homes actively for sale on a typical day in July compared to the previous year and more choice for buyers who are still looking for a new home.” The growth this year is certainly good news for you, especially if you’ve had trouble finding a home that meets your needs. If you start your search today, those additional options should make it less difficult to find a home than it would have been over the past two years. Bottom Line If you’re ready to jump into the market and take advantage of the increasing supply of homes for sale, let’s connect today. The opportunity is knocking, will you answer?

Read MoreWhy Today’s Housing Inventory Proves the Market Isn’t Headed for a Crash

Why Today’s Housing Inventory Proves the Market Isn’t Headed for a Crash Whether or not you owned a home in 2008, you likely remember the housing crash that took place back then. And news about an economic slowdown happening today may bring all those concerns back to the surface. While those feelings are understandable, data can help reassure you the situation today is nothing like it was in 2008. One of the key reasons why the market won’t crash this time is the current undersupply of inventory. Housing supply comes from three key places: Current homeowners putting their homes up for sale Newly built homes coming onto the market Distressed properties (short sales or foreclosures) For the market to crash, you’d have to make a case for an oversupply of inventory headed to the market, and the numbers just don’t support that. So, here’s a deeper look at where inventory is coming from today to help prove why the housing market isn’t headed for a crash. Current Homeowners Putting Their Homes Up for Sale Even though housing supply is increasing this year, there’s still a limited number of existing homes available. The graph below helps illustrate this point. Based on the latest weekly data, inventory is up 27.8% compared to the same week last year (shown in blue). But compared to the same week in 2019 (shown in the larger red bar), it’s still down by 42.6%. So, what does this mean? Inventory is still historically low. There simply aren’t enough homes on the market to cause prices to crash. There would need to be a flood of people getting ready to sell their houses in order to tip the scales toward a buyers’ market. And that level of activity simply isn’t there. Newly Built Homes Coming onto the Market There’s also a lot of talk about what’s happening with newly built homes today, and that may make you wonder if we’re overbuilding. But home builders are actually slowing down their production right now. Ali Wolf, Chief Economist at Zonda, notes: “It has become a very competitive market for builders where they are trying to offload any standing inventory.” To avoid repeating the overbuilding that happened leading up to the housing crisis, builders are reacting to higher mortgage rates and softening buyer demand by slowing down their work. It’s a sign they’re being intentional about not overbuilding homes like they did during the bubble. And according to the latest data from the U.S. Census, at today’s current pace, we’re headed to build a seasonally adjusted annual rate of about 1.4 million homes this year. While this will add more inventory to the market, it’s not on pace to create an oversupply because builders today are more cautious than the last time when they built more homes than the market could absorb. Distressed Properties (Short Sales or Foreclosures) The last place inventory can come from is distressed properties, including short sales and foreclosures. Back in the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to secure a home loan they couldn’t truly afford. Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM Data Solutions on properties with foreclosure filings to help paint the picture of how things have changed since the crash: This graph shows how in the time around the housing crash there were over one million foreclosure filings per year. As lending standards tightened since then, the activity started to decline. And in 2020 and 2021, the forbearance program was a further aid to help prevent a repeat of the wave of foreclosures we saw back around 2008. That program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market. Bottom Line Although housing supply is growing this year, the market certainly isn’t anywhere near the inventory levels that would cause prices to drop significantly. That’s why inventory tells us the housing market won’t crash.

Read MoreWhat Sellers Need To Know in Today’s Housing Market

What Sellers Need To Know in Today’s Housing Market If you’re thinking about selling your house, you may have heard about the housing market slowing down in recent months. While it’s still a sellers’ market, the peak frenzy the market saw over the past two years has cooled some. If you’re asking yourself if you’ve missed your chance to sell your house and make a move, the good news is you haven’t – motivated buyers are still out there. But you do need to price your house right for today’s market. Here’s why. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says: “Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers.” It’s true buyer demand has slowed over the past few months as higher mortgage rates made it more expensive to buy a home. The result is fewer bidding wars and less competition among buyers (see visual below): But don’t forget – that’s compared to the severely overheated market we saw over the past two years. According to the latest Confidence Index from NAR: “. . . 39% of homes sold above list price, down from 51% a month ago and 50% a year ago.” While this is a slower pace than even one month ago, serious buyers are still actively in the market, and they’re buying homes that are priced right. In fact, the Confidence Index also notes the average home is selling in just 14 days. If you’re aiming to sell your house, be sure you’re working with your agent to price it for today’s housing market. As buyer demand softens, it’s important to understand this isn’t the same market as last year. It’s not even the same market as just a few months ago. But it is still a sellers’ market. If you’re ready to sell your house, seek the advice of a real estate professional. In some cases, you’ll need to adjust your expectations accordingly to meet the market where it is today. Selma Hepp, Interim Lead, Deputy Chief Economist at CoreLogic, explains what’s happening and what it means when you sell: “Signs of a broader slowdown in the housing market are evident, . . . This is in line with our previous expectations and given the notable cooling of buyer demand due to higher mortgage rates. . . . Nevertheless, buyers still remain interested, which is keeping the market competitive — particularly for attractive homes that are properly priced.” Bottom Line While the housing market has cooled from its overheated frenzy, it’s still a sellers’ market. Let’s connect so you understand what’s happening with buyer demand and home prices in our local area as you get ready to enter the market.

Read More3 Tips for Buying a Home Today

3 Tips for Buying a Home Today If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options. But it’s important to keep in mind that while inventory is improving, it’s still a sellers’ market. And that means you need to be prepared as you set out on your home search. Here are three tips for buying the home of your dreams today. 1. Understand How Mortgage Rates Impact Your Homebuying Power Mortgage rates have increased significantly this year, and over the past few weeks, they’ve been fluctuating quite a bit. It’s important to stay up to date on what’s happening with rates and understand how they can impact your purchasing power when you’re thinking of buying a home. The chart below can help. Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within or below that range, while the red is a payment that exceeds it. As the chart shows, even a small change in mortgage rates can have a big impact on your monthly payments. If rates rise, you could exceed your budget unless you pursue a lower home loan amount. If rates fall, your purchasing power may increase, which could give you additional options for your search. 2. Be Open to Exploring Different Options During Your Search The supply of homes for sale is improving, which gives you more homes to choose from. But historically, supply is still low. That means as you search for homes, if you still don’t find something that meets your needs, it may be worth expanding your search. A recent article from the Washington Post highlights a few things buyers can consider today. It encourages opening yourself up to more areas. For example, if there’s a location you’ve previously ruled out (like a particular town, for example) it may be worth taking another look. And if you’re able to, opening your search up to include other housing types, like newly built homes, condominiums, or townhomes can further increase your pool of options. Even as the inventory of homes for sale improves today, finding ways to cast a wider net during your search could help you find a hidden gem. 3. Work with a Local Real Estate Professional for Expert Guidance Ultimately, you need to be prepared when you set out to buy a home. Jeff Ostrowski, Senior Mortgage Reporter for Bankrate, explains: “Taking the leap to homeownership can provide a feeling of pride while boosting your long-term financial outlook, if you go in well-prepared and with your eyes open.” No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional. If you’re just starting your search, a real estate professional can help you understand your local market and search for available homes. And when it’s time to make an offer, they’ll be an expert advisor and negotiator to help yours stand out above the rest. Bottom Line Strategically planning your home search by understanding today’s mortgage rates, casting a wide net, and building a team of experts can be the keys to finding the home of your dreams. To make sure you have expert advice each step of the way, let’s connect.

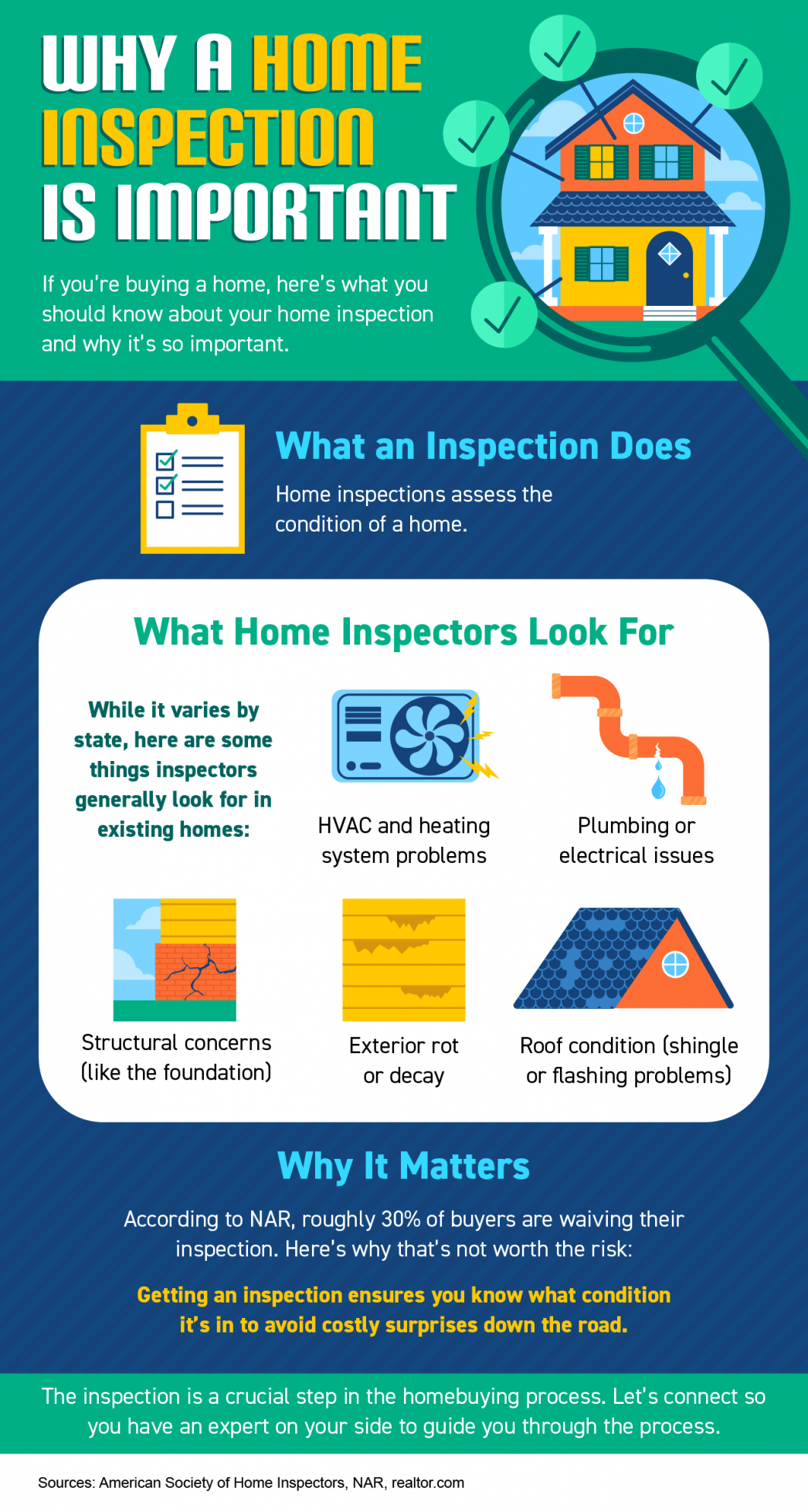

Read MoreWhy a Home Inspection Is Important

Why a Home Inspection Is Important Some Highlights If you’re buying a home, here’s what you should know about your home inspection and why it’s so important. A home inspection is a crucial step in the homebuying process. It assesses the condition of the home you plan to purchase so you can avoid costly surprises down the road. Let’s connect so you have an expert on your side to guide you through the process.

Read MorePlanning To Retire? Your Equity Can Help You Reach Your Goal.

Planning To Retire? Your Equity Can Help You Reach Your Goal. Whether you’ve just retired or you’re thinking about retirement, you may be considering your options and trying to picture a whole new stage of your life. And you’re not alone. Research from the Retirement Industry Trust Association (RITA) shows 10,000 Baby Boomers reach the typical retirement age (65) every day, and only 47% of the people in that generation have already retired. If this sounds like you, one thing worth considering is whether or not your current home will suit your new lifestyle. If your home doesn’t have the features or benefits you’re looking for, the good news is, you may be in a better position to move than you realize. That’s because, if you already own a home, you’ve likely built-up significant equity, and that can help you fuel your next move. According to the National Association of Realtors (NAR): “A homeowner who purchased a typical home five years ago would have gained $125,300 from just price appreciation alone.” In fact, over the last twelve months, CoreLogic reports the average homeowner in the United States gained roughly $64,000 in equity due to home price appreciation. You can use your equity to help you achieve your homeownership goals. Whether you want to downsize, move closer to loved ones, or buy a home in a dream destination, your equity can help get you there. It may be some (if not all) of what you’d need as your down payment on a home that better fits your changing needs. To find out how much equity to have in your home, reach out to a trusted real estate professional today. Bottom Line Retirement is a big step and so is buying or selling a home. As you move into this new phase of life, let's connect so you have an expert to guide you through the process as you sell your current home and give you expert advice as you buy one that’ll better suit your needs.

Read MoreExperts Increase 2022 Home Price Projections

Experts Increase 2022 Home Price Projections If you’re wondering if home prices are going to come down due to the cooldown in the housing market or a potential recession, here’s what you need to know. Not only are experts forecasting home prices will continue to appreciate nationwide this year, but most of them also actually increased their projections for home price appreciation from their original 2022 forecasts (shown in green in the chart below): As the chart shows, most sources adjusted up, and now call for more appreciation in 2022 than they originally projected this January. But why are experts so confident the housing market will see ongoing appreciation? It’s because of supply and demand in most markets. As Bankrate says: “After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.” Knowing that experts forecast home prices will continue to appreciate in most markets and that they’ve actually increased their original projections for this year should help you answer the question: will home prices fall? According to the latest forecasts, experts are confident prices will continue to appreciate this year, although at a more moderate rate than they did in 2021. Bottom Line If you’re worried home prices are going to decline, rest assured many experts raised their forecasts to say they’ll continue to appreciate in most markets this year. If you have questions about what’s happening with home prices in our local area, let's connect.

Read MoreWhat Would a Recession Mean for the Housing Market?

What Would a Recession Mean for the Housing Market? According to a recent survey from the Wall Street Journal, the percentage of economists who believe we’ll see a recession in the next 12 months is growing. When surveyed in July 2021, only 12% of economists consulted thought there’d be a recession by now. But this July, when polled, 49% believe we will see a recession in the coming 12 months. And as more recession talk fills the air, one concern many people have is: should I delay my homeownership plans if there’s a recession? Here’s a look at historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession would mean for the housing market today. A Recession Doesn’t Mean Falling Home Prices To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at the recessions going all the way back to 1980, home prices appreciated in four of the last six recessions. So, historically, when the economy slows down, it doesn’t mean home values will fall. Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would repeat what happened then. But this housing market isn’t about to crash. The fundamentals are very different today than they were in 2008. So, don’t assume we’re heading down the same path. A Recession Means Falling Mortgage Rates Research also helps paint the picture of how a recession could impact the cost of financing a home. As the chart below shows, historically, each time the economy slowed down, mortgage rates decreased. Fortune explains that mortgage rates typically fall during an economic slowdown: “Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.” And while history doesn’t always repeat itself, we can learn from and find comfort in the historical data. Bottom Line There’s no doubt everyone remembers what happened in the housing market in 2008. But you don’t need to fear the word recession if you’re planning to buy or sell a home. According to historical data, in most recessions, home price gains have stayed strong, and mortgage rates have declined. If you’re thinking about buying or selling a home, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

Read MoreThe U.S. Homeownership Rate Is Growing

The U.S. Homeownership Rate Is Growing The desire to own a home is still strong today. In fact, according to the Census, the U.S. homeownership rate is on the rise. To illustrate the increase, the graph below shows the homeownership rate over the last year: That data shows more than half of the U.S. population live in a home they own, and the percentage is growing with time. If you’re thinking about buying a home this year, here are just a few reasons why so many people see the value of homeownership. Why Are More People Becoming Homeowners? There are several benefits to owning your home. A significant one, especially when inflation is high like it is today, is that homeownership can help protect you from rising costs. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains: “In the 1970s, when inflation was running around 10%, home prices were rising at approximately the same rate. Renters actually have a harder time in inflationary periods, because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.” When you buy a home with a fixed-rate mortgage, you can lock in what's likely your biggest monthly expense – your housing payment – for the duration of that loan, often 15-30 years. That gives you a predictable monthly housing expense that can benefit you in the short term, but you’ll also gain equity over time as your home appreciates in value and you make your monthly mortgage payment. And with that growing equity, your net worth will increase as well. In fact, the latest data from NAR shows the median household net worth of a homeowner is roughly $300,000, while the median net worth of renters is only about $8,000. That means a homeowner’s net worth is nearly 40 times that of a renter. Bottom Line The U.S. homeownership rate is growing. If you’re ready to purchase the home of your dreams, let’s connect so you can begin the homebuying process today.

Read MoreWhy Experts Say the Housing Market Won’t Crash

Why Experts Say the Housing Market Won’t Crash Some Highlights Many people remember the housing crash in 2008, but experts say today’s market is fundamentally different in many ways. First, there isn’t an oversupply of homes for sale today. Plus, lending standards are much tighter, and homeowners have record levels of equity. That means signs say there won’t be a wave of foreclosures like the last time. If you have questions about the housing market, let’s connect.

Read MoreSelling Your House? Your Asking Price Matters More Now Than Ever

Selling Your House? Your Asking Price Matters More Now Than Ever There’s no doubt about the fact that the housing market is slowing from the frenzy we saw over the past two years. But what does that mean for you if you’re thinking of selling your house? While home prices are still appreciating in most markets and experts say that will continue, they’re climbing at a slower pace because rising mortgage rates are creating less buyer demand. Because of this, there are more homes on the market. And in a shift like this one, the way you price your home matters more than ever. Why Today’s Housing Market Is Different During the pandemic, sellers could price their homes higher because demand was so high, and supply was so low. This year, things are shifting, and that means your approach to pricing your house needs to shift too. Because we’re seeing less buyer demand, sellers have to recognize this is a different market than it was during the pandemic. Here’s what’s at stake if you don’t. Why Pricing Your House at Market Value Matters The price you set for your house sends a message to potential buyers. If you price it too high, you run the risk of deterring buyers. When that happens, you may have to lower the price to try to reignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder what that means about the home or if in fact it’s still overpriced. Some sellers aren’t adjusting their expectations to today’s market, and realtor.com explains the impact that’s having: “. . . the share of listings with a price cut was nearly double its year ago level even as it remains well below pre-pandemic levels.” To avoid the headache of having to lower your price, you’ll want to price it right from the onset. A real estate advisor knows how to determine that perfect asking price. To find the right price, they balance the value of homes in your neighborhood, current market trends and buyer demand, the condition of your house, and more. Not to mention, pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. This helps lead to stronger offers and a greater likelihood it’ll sell quickly. Why You Still Have an Opportunity When You Sell Today Rest assured, it’s still a sellers’ market, and you’ll still get great benefits if you plan accordingly and work with an agent to set your price at the current market value. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says: “Homes priced right are selling very quickly, but homes priced too high are deterring prospective buyers.” Mike Simonsen, the Founder and CEO of Altos Research, also notes: “We can see that demand is still there for the homes that are priced properly.” Bottom Line Homes priced right are selling quickly in today’s real estate market. Let's connect to make sure you price your house based on current market conditions so you can maximize your sales potential and minimize your hassle in a shifting market.

Read MoreIs the Shifting Market a Challenge or an Opportunity for Homebuyers?

Is the Shifting Market a Challenge or an Opportunity for Homebuyers? If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers competed with one another to be the winning offer. But what was once your greatest challenge may now be your greatest opportunity. Today, data shows buyer demand is moderating in the wake of higher mortgage rates. Here are a few reasons why this shift in the housing market is good news for your homebuying plans. The Challenge There were many reasons for the limited number of homes on the market during the pandemic, including a history of underbuilding new homes since the market crash in 2008. As the graph below shows, housing supply is well below what the market has seen for most of the past 10 years (see graph below): The Opportunity But that graph also shows a trend back up in the right direction this year. That’s because moderating demand is slowing the pace of home sales and that’s one of the reasons housing supply is finally able to grow. For you, that means you’ll have more options to choose from, so it shouldn’t be as difficult to find your next home as it has been recently. And having more options may also lead to less intense bidding wars. Data from the Realtors Confidence Index from the National Association of Realtors (NAR) shows this trend has already begun. In their recent reports, bidding wars are easing month-over-month (see graph below): If you’ve been outbid before or you’ve struggled to find a home that meets your needs, breathe a welcome sigh of relief. The big takeaway here is you have more options and less competition today. Just remember, while easing, data shows multiple-offer scenarios are still happening – they’re just not as intense as they were over the past year. You should still lean on an agent to guide you through the process and help you make your strongest offer up front. Bottom Line If you’re still looking to make a move, it may be time to pick your home search back up today. Let’s connect to kick off the homebuying process.

Read MoreWhat Does the Rest of the Year Hold for Home Prices?

What Does the Rest of the Year Hold for Home Prices? Whether you’re a potential homebuyer, seller, or both, you probably want to know: will home prices fall this year? Let’s break down what’s happening with home prices, where experts say they’re headed, and why this matters for your homeownership goals. Last Year’s Rapid Home Price Growth Wasn’t the Norm In 2021, home prices appreciated quickly. One reason why is that record-low mortgage rates motivated more buyers to enter the market. As a result, there were more people looking to make a purchase than there were homes available for sale. That led to competitive bidding wars which drove prices up. CoreLogic helps explain how unusual last year’s appreciation was: “Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%.” In other words, the pace of appreciation in 2021 far surpassed the 6% the market saw in 2020. And even that appreciation was greater than the pre-pandemic norm which was typically around 3.8%. This goes to show, 2021 was an anomaly in the housing market spurred by more buyers than homes for sale. Home Price Appreciation Moderates Today This year, home price appreciation is slowing (or decelerating) from the feverish pace the market saw over the past two years. According to the latest forecasts, experts say on average, nationwide, prices will still appreciate by roughly 10% in 2022 (see graph below): Why do all of these experts agree prices will continue to rise? It’s simple. Even though housing supply is growing today, it’s still low overall thanks to several factors, including a long period of underbuilding homes. And experts say that’s going to help keep upward pressure on home prices this year. Additionally, since mortgage rates are higher this year than they were last year, buyer demand has slowed. As the market undergoes this change, it’s true price appreciation this year won’t match the feverish pace in 2021. But the rapid appreciation the market saw last year wasn’t sustainable anyway. What Does That Mean for You? Today, the market is beginning to move back toward pre-pandemic levels. But even the forecast for 10% home price growth in 2022 is well beyond the 3.8% that’s more typical for a normal market. So, despite what you may have heard, experts say home prices won’t fall in most markets. They’ll just appreciate more moderately. If you’re worried the house you’re trying to sell or the home you want to buy will decrease in value, you should know experts aren’t calling for depreciation in most markets, just deceleration. That means your home should still grow in value, just not as fast as it did last year. Bottom Line If you’re thinking of making a move, you shouldn’t wait for prices to fall. Experts say nationally, prices will continue to appreciate this year, just at a more moderate pace. When you’re ready to begin the process of buying or selling, let’s connect so you have a local market expert on your side each step of the way.

Read MoreMore People Are Finding the Benefits of Multigenerational Households Today

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational living has increased over the past 50 years. As you consider this option for your own home search, know it could help you on your homeownership journey and provide you with other incredible benefits along the way. Living with Loved Ones Could Help You Achieve Your Homeownership Goals There are several reasons people choose to live in a multigenerational household, and for many, the arrangement is a personal one. But according to the Pew Research Center, the top reason people choose to live together today is financial. A recent study from Freddie Mac also finds more people are choosing to buy a home together so they can save money in the homebuying process. As the study says: “. . . an increasing percentage of young adult first-time homebuyers are relying on support from older generations, including their parents, to buy a home together.” For these individuals, combining their resources can help them achieve their dream of buying and owning a home. By pooling their incomes together to make that purchase, they may be able to afford a home they couldn’t on their own. Other Key Benefits of Multigenerational Living Not to mention, living in a home with loved ones can have other benefits too, like giving you more quality time to spend together. Darla Mercado, Certified Financial Planner and Markets Editor for CNBC.com, explains how this living arrangement can help on a personal and financial level: “Residing with relatives can offer advantages . . . you can pool multiple streams of income, for instance. And in households with young children, grandparents can pitch in with child care.” If this sounds like a great option for you, it’s important to work with a trusted real estate professional to discuss your needs. They can help you navigate the process to find the right home for you and your loved ones. Bottom Line More people are discovering the benefits of multigenerational living. For the best information and help deciding what’s right for your personal situation, let’s connect and start the conversation today. Content previously posted on Keeping Current Matters

Read MoreWhy the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over a decade ago. Thankfully, the forbearance program changed that. It provided much-needed relief for homeowners so a foreclosure crisis wouldn’t happen again. Here’s why forbearance worked. Forbearance enabled nearly five million homeowners to get back on their feet in a time when having the security and protection of a home was more important than ever. Those in need were able to work with their banks and lenders to stay in their homes rather than go into foreclosure. Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA), notes: “Most borrowers exiting forbearance are moving into either a loan modification, payment deferral, or a combination of the two workout options." As the graph below shows, with modification, deferral, and workout options in place, four out of every five homeowners in forbearance are either paid in full or are exiting with a plan. They’re able to stay in their homes. What does this mean for the housing market? Since so many people can stay in their homes and work out alternative options, there won’t be a wave of foreclosures coming to the market. And while rising slightly since the foreclosure moratorium was lifted this year, foreclosures today are still nowhere near the levels seen in the housing crisis. Forbearance wasn’t the only game changer, either. Lending standards have improved significantly since the housing bubble burst, and that’s one more thing keeping foreclosure filings low. Today’s borrowers are much more qualified to pay their home loans. And while the majority of homeowners are exiting the forbearance program with a plan, for those who still need to make a change due to financial hardship or other challenges, today’s record-level of equity is giving them the opportunity to sell their houses and avoid foreclosure altogether. Homeowners have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Thanks to their equity and the current undersupply of homes on the market, homeowners can sell their houses, make a move, and not have to go through the foreclosure process that led to the housing market crash in 2008. Thomas LaSalvia, Chief Economist with Moody’s Analytics, states: “There's some excess savings out there, over 2 trillion worth. . . . There are people that have ownership of those homes right now, that even in a downturn, they'd still likely be able to pay that mortgage and won't have to hand over keys. And there won't be a lot of those distressed sales that happened in the 2008 crisis.” Bottom Line The forbearance program was a game changer for homeowners in need. It’s one of the big reasons why we won’t see a wave of foreclosures coming to the market.

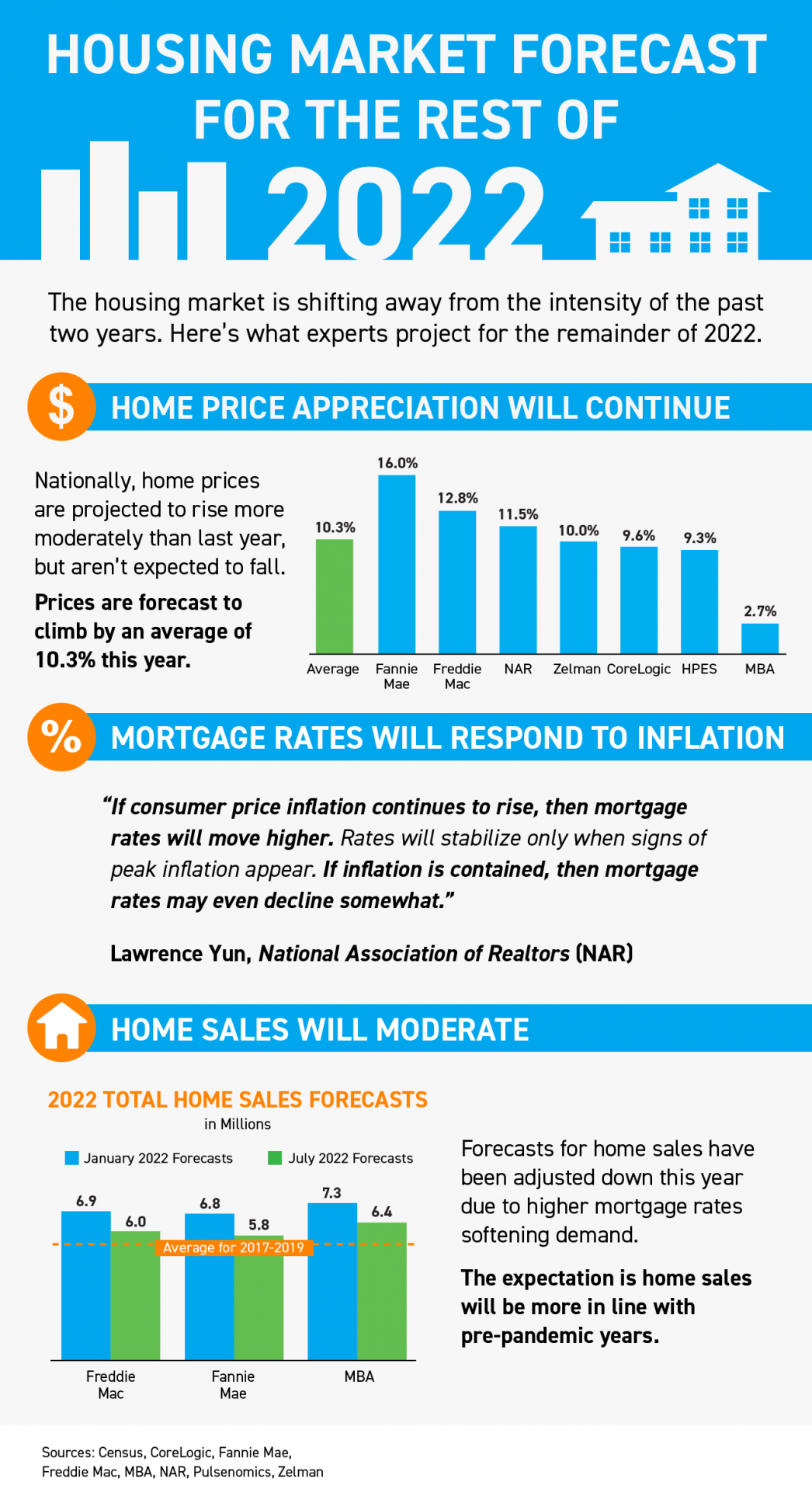

Read MoreHousing Market Forecast for the Rest of 2022

Housing Market Forecast for the Rest of 2022 Some Highlights The housing market is shifting away from the intensity of the past two years. Here’s what experts project for the remainder of 2022. Home prices are forecast to rise more moderately than last year. Mortgage rates will respond to inflation, and home sales will be more in line with pre-pandemic years. Let’s connect so you can make your best move this year.

Read MoreWhy It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal. Even though the supply of homes for sale has been growing this year, there’s still a shortage of homes on the market. And that means conditions continue to favor sellers today. That’s because the level of inventory of homes for sale can help determine if buyers or sellers are in the driver’s seat. Think of it like this: A buyers’ market is when there are more homes for sale than buyers looking to buy. When that happens, buyers have the negotiation power because sellers are more willing to compromise so they can sell their house. In a sellers’ market, it’s just the opposite. There are too few homes available for the number of buyers in the market and that gives the seller all the leverage. In that situation, buyers will do what they can to compete for the limited number of homes for sale. A neutral market is when supply is balanced and there are enough homes to meet buyer demand at the current sales pace. And for the past two years, we’ve been in a red-hot sellers’ market because inventory has been near record lows. The blue section of this graph highlights just how far below a neutral market inventory still is today. What Does This Mean for You? Ed Pinto, Director of the American Enterprise Institute’s Housing Center, gives a perfect summary of what’s happening in today’s market, saying: “Overall, the best summary is that we'll move from a gangbuster sellers' market to a modest sellers' market.” Conditions are still in your favor even though the market is cooling. If you work with an agent to price your house at market value, you’ll find success when you sell your house today. While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed. Bottom Line Today’s housing market still favors sellers. If you’re ready to sell your house, let’s connect so you can start making your moves.

Read MoreBuying a Home May Make More Financial Sense Than Renting One

Buying a Home May Make More Financial Sense Than Renting One If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says: “The median rent across the 50 largest US metropolitan areas reached $1,876 in June, a new record level for Realtor.com data for the 16th consecutive month.” That means rising prices will likely impact your housing plans either way. But there are a few key differences that could make buying a home a more worthwhile option for you. If You Need More Space, Buying a Home May Be More Affordable What you may not realize is that, according to the latest data from realtor.com and the National Association of Realtors (NAR), it may actually be more affordable to buy than rent depending on how many bedrooms you need. The graph below uses the median rental payment and median mortgage payment across the country to show why. As the graph conveys, if you need two or more bedrooms, it may actually be more affordable to buy a home even as prices rise. While this doesn’t take into consideration the interest deduction or other financial advantages that come with owning a home, it does help paint the picture that it may be more affordable to buy then rent for that unit size based on nationwide averages. So, if one of the factors motivating you to move is a desire for more space, this could be the added encouragement you need to consider homeownership. Homeownership Also Provides Stability and a Chance To Grow Your Wealth In addition to being more affordable depending on how many bedrooms you need, buying has two other key benefits: payment stability and equity. When you buy a home, you lock in your monthly payment with your fixed-rate mortgage. And that’s especially important in today’s inflationary economy. With inflation, prices rise across the board for things like gas, groceries, and more. Locking in your housing payment, which is likely your largest monthly expense, can provide greater long-term stability and help shield you from those rising expenses moving forward. Renting doesn’t provide that same predictability. A recent article from CNET explains it like this: “...if you buy a house and secure a fixed-rate mortgage, that means that no matter how much prices or interest rates go up, your fixed payment will stay the same every month. That's an advantage over renting since there's a good chance your landlord will raise your rent to counter inflationary pressures.” Not to mention, when you buy, you have the chance to build equity, which in turn grows your net worth. It works like this. As you pay down your home loan over time and as home values continue to appreciate, so does your equity. And that equity can make it easier to fuel a move into a future home if you decide you need a bigger home later on. Again, the CNET article mentioned above helps explain: “Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home that you can tap into later on. When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.” Bottom Line If you’re trying to decide whether to keep renting or buy a home, let’s connect to explore your options. With home equity and a shield against inflation on the line, it may make more sense to buy a home if you’re able to.

Read More3 Graphs To Show This Isn’t a Housing Bubble

3 Graphs To Show This Isn’t a Housing Bubble With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time. There’s a Shortage of Homes on the Market Today, Not a Surplus The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to tumble. Today, supply is growing, but there’s still a shortage of inventory available. The graph below uses data from the National Association of Realtors (NAR) to show how this time compares to the crash. Today, unsold inventory sits at just a 3.0-months’ supply at the current sales pace. One of the reasons inventory is still low is because of sustained underbuilding. When you couple that with ongoing buyer demand as millennials age into their peak homebuying years, it continues to put upward pressure on home prices. That limited supply compared to buyer demand is why experts forecast home prices won’t fall this time. Mortgage Standards Were Much More Relaxed During the Crash During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. The graph below showcases data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The higher the number, the easier it is to get a mortgage. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies. Mark Fleming, Chief Economist at First American, says: “Credit standards tightened in recent months due to increasing economic uncertainty and monetary policy tightening.” Stricter standards, like there are today, help prevent a risk of a rash of foreclosures like there was last time. The Foreclosure Volume Is Nothing Like It Was During the Crash The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been on the way down since the crash because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help tell the story: In addition, homeowners today are equity rich, not tapped out. In the run-up to the housing bubble, some homeowners were using their homes as personal ATMs. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at considerable discounts that lowered the value of other homes in the area. Today, prices have risen nicely over the last few years, and that’s given homeowners an equity boost. According to Black Knight: “In total, mortgage holders gained $2.8 trillion in tappable equity over the past 12 months – a 34% increase that equates to more than $207,000 in equity available per borrower. . . .” With the average home equity now standing at $207,000, homeowners are in a completely different position this time. Bottom Line If you’re worried we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your concerns. Concrete data and expert insights clearly show why this is nothing like the last time.

Read MoreTop Questions About Selling Your Home This Winter

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision. 1. Should I Wait To Sell? Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market: While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year. 2. Are Buyers Still Out There? If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains: “At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.” While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. 3. Can I Afford To Buy My Next Home? If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize. Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American: “. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.” Bottom Line If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today. Content previously posted on Keeping Current Matters

Read More

Categories

Recent Posts