What Does the Rest of the Year Hold for Home Prices?

What Does the Rest of the Year Hold for Home Prices? Whether you’re a potential homebuyer, seller, or both, you probably want to know: will home prices fall this year? Let’s break down what’s happening with home prices, where experts say they’re headed, and why this matters for your homeownership goals. Last Year’s Rapid Home Price Growth Wasn’t the Norm In 2021, home prices appreciated quickly. One reason why is that record-low mortgage rates motivated more buyers to enter the market. As a result, there were more people looking to make a purchase than there were homes available for sale. That led to competitive bidding wars which drove prices up. CoreLogic helps explain how unusual last year’s appreciation was: “Price appreciation averaged 15% for the full year of 2021, up from the 2020 full year average of 6%.” In other words, the pace of appreciation in 2021 far surpassed the 6% the market saw in 2020. And even that appreciation was greater than the pre-pandemic norm which was typically around 3.8%. This goes to show, 2021 was an anomaly in the housing market spurred by more buyers than homes for sale. Home Price Appreciation Moderates Today This year, home price appreciation is slowing (or decelerating) from the feverish pace the market saw over the past two years. According to the latest forecasts, experts say on average, nationwide, prices will still appreciate by roughly 10% in 2022 (see graph below): Why do all of these experts agree prices will continue to rise? It’s simple. Even though housing supply is growing today, it’s still low overall thanks to several factors, including a long period of underbuilding homes. And experts say that’s going to help keep upward pressure on home prices this year. Additionally, since mortgage rates are higher this year than they were last year, buyer demand has slowed. As the market undergoes this change, it’s true price appreciation this year won’t match the feverish pace in 2021. But the rapid appreciation the market saw last year wasn’t sustainable anyway. What Does That Mean for You? Today, the market is beginning to move back toward pre-pandemic levels. But even the forecast for 10% home price growth in 2022 is well beyond the 3.8% that’s more typical for a normal market. So, despite what you may have heard, experts say home prices won’t fall in most markets. They’ll just appreciate more moderately. If you’re worried the house you’re trying to sell or the home you want to buy will decrease in value, you should know experts aren’t calling for depreciation in most markets, just deceleration. That means your home should still grow in value, just not as fast as it did last year. Bottom Line If you’re thinking of making a move, you shouldn’t wait for prices to fall. Experts say nationally, prices will continue to appreciate this year, just at a more moderate pace. When you’re ready to begin the process of buying or selling, let’s connect so you have a local market expert on your side each step of the way.

Read MoreMore People Are Finding the Benefits of Multigenerational Households Today

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational living has increased over the past 50 years. As you consider this option for your own home search, know it could help you on your homeownership journey and provide you with other incredible benefits along the way. Living with Loved Ones Could Help You Achieve Your Homeownership Goals There are several reasons people choose to live in a multigenerational household, and for many, the arrangement is a personal one. But according to the Pew Research Center, the top reason people choose to live together today is financial. A recent study from Freddie Mac also finds more people are choosing to buy a home together so they can save money in the homebuying process. As the study says: “. . . an increasing percentage of young adult first-time homebuyers are relying on support from older generations, including their parents, to buy a home together.” For these individuals, combining their resources can help them achieve their dream of buying and owning a home. By pooling their incomes together to make that purchase, they may be able to afford a home they couldn’t on their own. Other Key Benefits of Multigenerational Living Not to mention, living in a home with loved ones can have other benefits too, like giving you more quality time to spend together. Darla Mercado, Certified Financial Planner and Markets Editor for CNBC.com, explains how this living arrangement can help on a personal and financial level: “Residing with relatives can offer advantages . . . you can pool multiple streams of income, for instance. And in households with young children, grandparents can pitch in with child care.” If this sounds like a great option for you, it’s important to work with a trusted real estate professional to discuss your needs. They can help you navigate the process to find the right home for you and your loved ones. Bottom Line More people are discovering the benefits of multigenerational living. For the best information and help deciding what’s right for your personal situation, let’s connect and start the conversation today. Content previously posted on Keeping Current Matters

Read MoreWhy the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over a decade ago. Thankfully, the forbearance program changed that. It provided much-needed relief for homeowners so a foreclosure crisis wouldn’t happen again. Here’s why forbearance worked. Forbearance enabled nearly five million homeowners to get back on their feet in a time when having the security and protection of a home was more important than ever. Those in need were able to work with their banks and lenders to stay in their homes rather than go into foreclosure. Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association (MBA), notes: “Most borrowers exiting forbearance are moving into either a loan modification, payment deferral, or a combination of the two workout options." As the graph below shows, with modification, deferral, and workout options in place, four out of every five homeowners in forbearance are either paid in full or are exiting with a plan. They’re able to stay in their homes. What does this mean for the housing market? Since so many people can stay in their homes and work out alternative options, there won’t be a wave of foreclosures coming to the market. And while rising slightly since the foreclosure moratorium was lifted this year, foreclosures today are still nowhere near the levels seen in the housing crisis. Forbearance wasn’t the only game changer, either. Lending standards have improved significantly since the housing bubble burst, and that’s one more thing keeping foreclosure filings low. Today’s borrowers are much more qualified to pay their home loans. And while the majority of homeowners are exiting the forbearance program with a plan, for those who still need to make a change due to financial hardship or other challenges, today’s record-level of equity is giving them the opportunity to sell their houses and avoid foreclosure altogether. Homeowners have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Thanks to their equity and the current undersupply of homes on the market, homeowners can sell their houses, make a move, and not have to go through the foreclosure process that led to the housing market crash in 2008. Thomas LaSalvia, Chief Economist with Moody’s Analytics, states: “There's some excess savings out there, over 2 trillion worth. . . . There are people that have ownership of those homes right now, that even in a downturn, they'd still likely be able to pay that mortgage and won't have to hand over keys. And there won't be a lot of those distressed sales that happened in the 2008 crisis.” Bottom Line The forbearance program was a game changer for homeowners in need. It’s one of the big reasons why we won’t see a wave of foreclosures coming to the market.

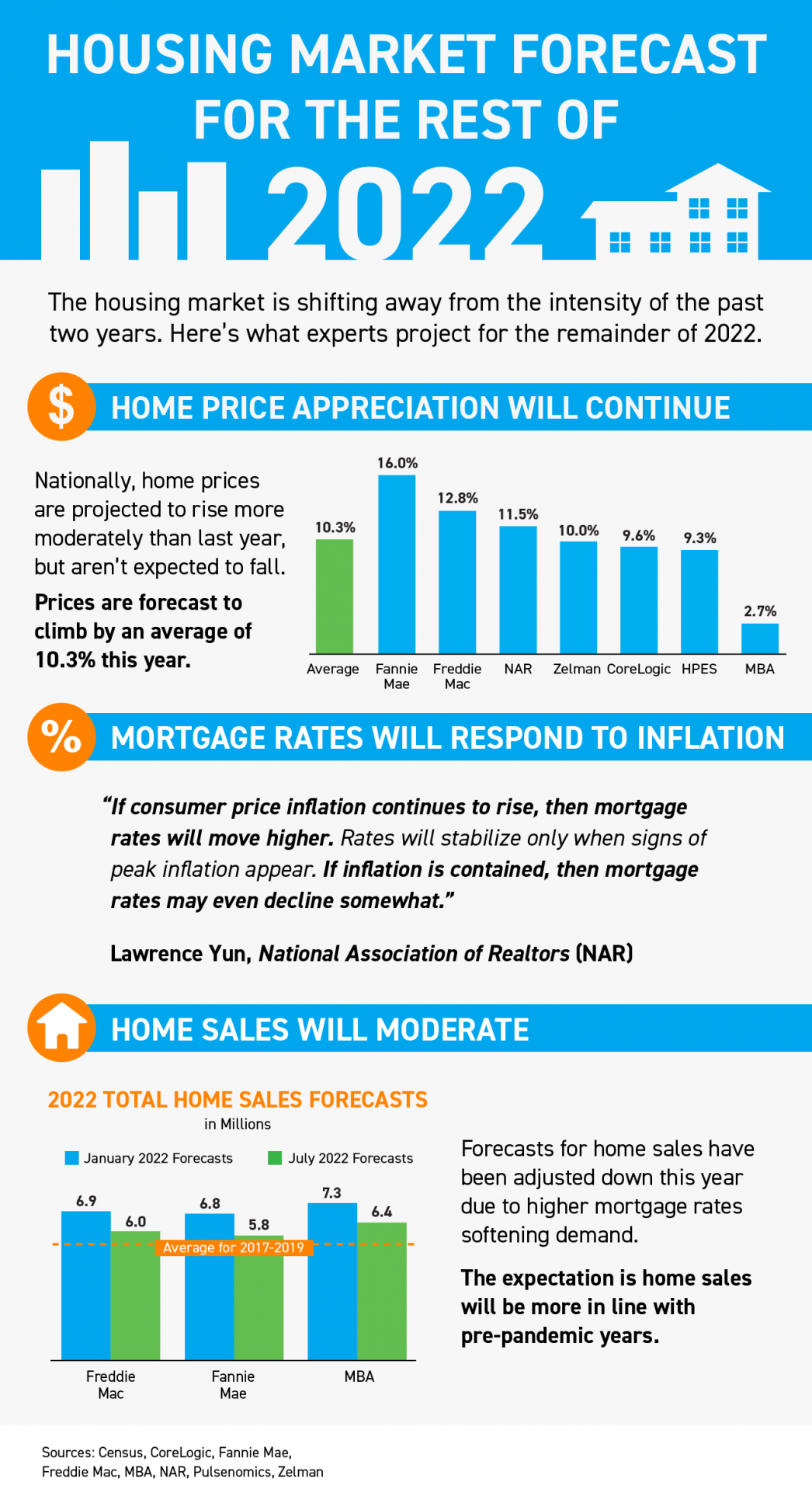

Read MoreHousing Market Forecast for the Rest of 2022

Housing Market Forecast for the Rest of 2022 Some Highlights The housing market is shifting away from the intensity of the past two years. Here’s what experts project for the remainder of 2022. Home prices are forecast to rise more moderately than last year. Mortgage rates will respond to inflation, and home sales will be more in line with pre-pandemic years. Let’s connect so you can make your best move this year.

Read MoreWhy It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is still anything but normal. Even though the supply of homes for sale has been growing this year, there’s still a shortage of homes on the market. And that means conditions continue to favor sellers today. That’s because the level of inventory of homes for sale can help determine if buyers or sellers are in the driver’s seat. Think of it like this: A buyers’ market is when there are more homes for sale than buyers looking to buy. When that happens, buyers have the negotiation power because sellers are more willing to compromise so they can sell their house. In a sellers’ market, it’s just the opposite. There are too few homes available for the number of buyers in the market and that gives the seller all the leverage. In that situation, buyers will do what they can to compete for the limited number of homes for sale. A neutral market is when supply is balanced and there are enough homes to meet buyer demand at the current sales pace. And for the past two years, we’ve been in a red-hot sellers’ market because inventory has been near record lows. The blue section of this graph highlights just how far below a neutral market inventory still is today. What Does This Mean for You? Ed Pinto, Director of the American Enterprise Institute’s Housing Center, gives a perfect summary of what’s happening in today’s market, saying: “Overall, the best summary is that we'll move from a gangbuster sellers' market to a modest sellers' market.” Conditions are still in your favor even though the market is cooling. If you work with an agent to price your house at market value, you’ll find success when you sell your house today. While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed. Bottom Line Today’s housing market still favors sellers. If you’re ready to sell your house, let’s connect so you can start making your moves.

Read MoreBuying a Home May Make More Financial Sense Than Renting One

Buying a Home May Make More Financial Sense Than Renting One If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says: “The median rent across the 50 largest US metropolitan areas reached $1,876 in June, a new record level for Realtor.com data for the 16th consecutive month.” That means rising prices will likely impact your housing plans either way. But there are a few key differences that could make buying a home a more worthwhile option for you. If You Need More Space, Buying a Home May Be More Affordable What you may not realize is that, according to the latest data from realtor.com and the National Association of Realtors (NAR), it may actually be more affordable to buy than rent depending on how many bedrooms you need. The graph below uses the median rental payment and median mortgage payment across the country to show why. As the graph conveys, if you need two or more bedrooms, it may actually be more affordable to buy a home even as prices rise. While this doesn’t take into consideration the interest deduction or other financial advantages that come with owning a home, it does help paint the picture that it may be more affordable to buy then rent for that unit size based on nationwide averages. So, if one of the factors motivating you to move is a desire for more space, this could be the added encouragement you need to consider homeownership. Homeownership Also Provides Stability and a Chance To Grow Your Wealth In addition to being more affordable depending on how many bedrooms you need, buying has two other key benefits: payment stability and equity. When you buy a home, you lock in your monthly payment with your fixed-rate mortgage. And that’s especially important in today’s inflationary economy. With inflation, prices rise across the board for things like gas, groceries, and more. Locking in your housing payment, which is likely your largest monthly expense, can provide greater long-term stability and help shield you from those rising expenses moving forward. Renting doesn’t provide that same predictability. A recent article from CNET explains it like this: “...if you buy a house and secure a fixed-rate mortgage, that means that no matter how much prices or interest rates go up, your fixed payment will stay the same every month. That's an advantage over renting since there's a good chance your landlord will raise your rent to counter inflationary pressures.” Not to mention, when you buy, you have the chance to build equity, which in turn grows your net worth. It works like this. As you pay down your home loan over time and as home values continue to appreciate, so does your equity. And that equity can make it easier to fuel a move into a future home if you decide you need a bigger home later on. Again, the CNET article mentioned above helps explain: “Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you're building equity in your home that you can tap into later on. When you rent, you aren't investing in your financial future the same way you are when you're paying off a mortgage.” Bottom Line If you’re trying to decide whether to keep renting or buy a home, let’s connect to explore your options. With home equity and a shield against inflation on the line, it may make more sense to buy a home if you’re able to.

Read More3 Graphs To Show This Isn’t a Housing Bubble

3 Graphs To Show This Isn’t a Housing Bubble With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. The good news is, there’s concrete data to show why this is nothing like the last time. There’s a Shortage of Homes on the Market Today, Not a Surplus The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to tumble. Today, supply is growing, but there’s still a shortage of inventory available. The graph below uses data from the National Association of Realtors (NAR) to show how this time compares to the crash. Today, unsold inventory sits at just a 3.0-months’ supply at the current sales pace. One of the reasons inventory is still low is because of sustained underbuilding. When you couple that with ongoing buyer demand as millennials age into their peak homebuying years, it continues to put upward pressure on home prices. That limited supply compared to buyer demand is why experts forecast home prices won’t fall this time. Mortgage Standards Were Much More Relaxed During the Crash During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. The graph below showcases data on the Mortgage Credit Availability Index (MCAI) from the Mortgage Bankers Association (MBA). The higher the number, the easier it is to get a mortgage. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies. Mark Fleming, Chief Economist at First American, says: “Credit standards tightened in recent months due to increasing economic uncertainty and monetary policy tightening.” Stricter standards, like there are today, help prevent a risk of a rash of foreclosures like there was last time. The Foreclosure Volume Is Nothing Like It Was During the Crash The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been on the way down since the crash because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help tell the story: In addition, homeowners today are equity rich, not tapped out. In the run-up to the housing bubble, some homeowners were using their homes as personal ATMs. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at considerable discounts that lowered the value of other homes in the area. Today, prices have risen nicely over the last few years, and that’s given homeowners an equity boost. According to Black Knight: “In total, mortgage holders gained $2.8 trillion in tappable equity over the past 12 months – a 34% increase that equates to more than $207,000 in equity available per borrower. . . .” With the average home equity now standing at $207,000, homeowners are in a completely different position this time. Bottom Line If you’re worried we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your concerns. Concrete data and expert insights clearly show why this is nothing like the last time.

Read MoreTop Questions About Selling Your Home This Winter

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision. 1. Should I Wait To Sell? Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market: While buyers have regained some negotiation power as inventory has grown, you haven’t missed your window to sell. Your house could still stand out since inventory is low, especially if you list now while other sellers hold off until after the holiday rush and the start of the new year. 2. Are Buyers Still Out There? If you’re thinking of selling your house but are hesitant because you’re worried buyer demand has disappeared in the face of higher mortgage rates, know that isn’t the case for everyone. While demand has eased this year, millennials are still looking for homes. As an article in Forbes explains: “At about 80 million strong, millennials currently make up the largest share of homebuyers (43%) in the U.S., according to a recent National Association of Realtors (NAR) report. Simply due to their numbers and eagerness to become homeowners, this cohort is quite literally shaping the next frontier of the homebuying process. Once known as the ‘rent generation,’ millennials have proven to be savvy buyers who are quite nimble in their quest to own real estate. In fact, I don’t think it’s a stretch to say they are the key to the overall health and stability of the current housing industry.” While the millennial generation has been dubbed the renter generation, that namesake may not be appropriate anymore. Millennials, the largest generation, are actually a significant driving force for buyer demand in the housing market today. If you’re wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. 3. Can I Afford To Buy My Next Home? If current market conditions have you worried about how you’ll afford your next move, consider this: you may have more equity in your current home than you realize. Homeowners have gained significant equity over the past few years and that equity can make a big difference in the affordability equation, especially with mortgage rates higher now than they were last year. According to Mark Fleming, Chief Economist at First American: “. . . homeowners, in aggregate, have historically high levels of home equity. For some of those equity-rich homeowners, that means moving and taking on a higher mortgage rate isn’t a huge deal—especially if they are moving to a more affordable city.” Bottom Line If you’re thinking about selling your house this season, let’s connect so you have the expert insights you need to make the best possible move today. Content previously posted on Keeping Current Matters

Read More-

To Visit the Schools website, Click here. Directions to the School 1400 Jackson Keller, San Antonio, TX 78213 For the school, schedule Click Here Call the School (210)-356-7400

Read More Why It May Be Time To Add Newly Built Homes to Your Search

If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. If you’re willing to work with a trusted agent to consider a newly built home, you may have even more options and incentives than you realize. That may be why the National Association of Home Builders (NAHB) says the share of buyers looking for new construction is increasing: “According to the quarterly Housing Trends Report, the popularity of new construction homes is continuing to rebound . . .” Here’s a few reasons more buyers may be drawn to newly built homes. More Options To Choose from and Potential Builder Incentives When looking for a home, you can choose between existing homes (those that are already built and previously owned) and newly constructed ones. While the inventory of existing homes has increased this year, it’s still below more typical years like 2019. Currently, according to the National Association of Realtors (NAR), there is a 3.2-month supply at the current sales pace. For reference, a roughly 6-month supply is considered a balanced market, leaving us in a sellers’ market today. While it’s a smaller segment of the overall inventory of homes for sale, the supply of newly built homes has grown even more. The National Association of Home Builders (NAHB) explains: “New single-family home inventory remained elevated at a 9.2 months’ supply (of varying stages of construction). A measure near a 6 months’ supply is considered balanced.” Here’s why this matters for you. While you have more homes to choose from in either category, there’s one extra benefit of newly built homes. Because the inventory of newly built homes has grown so much, builders are motivated to sell their properties before they build more. Back in the housing crash of 2008, builders were building too many homes, and that oversupply is part of what contributed to the housing bubble bursting. Now, builders don’t want to have a surplus of inventory in their pipeline, and many are offering buyers incentives to help move that inventory along. As Doug Duncan, Chief Economist at Fannie Mae, explains: “. . . a continual increase in the number of completed homes available for sale is now occurring, with the inventories of such homes now at the highest level since July 2020. . . . This suggests to us that builders may be increasingly willing to offer more aggressive incentives and discounts to maintain sales of completed inventory.” While specifics will vary by builder and market, some buyers are seeing builders reduce prices and offer incentives. To find out what’s available in your area, lean on a trusted real estate professional. Lifestyle Benefits of Buying a Newly Built Home In addition to more supply and the potential for builder incentives, newly built homes have various benefits that may suit your lifestyle. For example, you likely won’t have as many little repairs to tackle, like leaky faucets, shutters to paint, and other odd jobs around the house. That can free up time for you to do other things you’re passionate about. Another perk of a new home is that nothing in the house is used. It’s brand new and uniquely yours from day one. You’ll have all new appliances, windows, roofing, and more. These things can help lower your energy costs, which can add up to significant savings over time. You may even have the latest and greatest technology features built into your new home. Builder sums up why some buyers today are turning to newly built homes: “For some, it’s the lure of something new and modern. For others, it’s the move-in ready experience. And now there’s another factor to consider when making this decision: technology.” If any of these benefits appeal to you, it’s time to connect with a trusted real estate advisor to learn more. Bottom Line If you’re considering a newly built home, let’s connect so you have an expert guide on what’s available in our local market. Together we’ll explore your options and the benefits of an all-new home. Content previously posted on Keeping Current Matters

Read MoreHome Equity: A Source of Strength for Homeowners Today

Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says: “. . . don’t expect a housing bust like the mid-2000s, as lending standards in this housing cycle have been much tighter and homeowners have historically high levels of home equity, so there likely won’t be a surge in foreclosures.” Data from the Mortgage Bankers Association (MBA) helps tell this story. It shows the overall percentage of homeowners at risk is decreasing significantly with time (see graph below): But even though the volume of homeowners at risk is very low, there is still a small percentage of homeowners who may be coming face to face with foreclosure as a possibility today. If you’re facing difficulties yourself, it can help to understand your options. It starts with knowing what foreclosure is. Investopedia defines it like this: “Typically, default is triggered when a borrower misses a specific number of monthly payments . . . Foreclosure is the legal process by which a lender attempts to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property.” The good news is there are alternatives available to help you avoid going through the foreclosure process, including: Reinstatement Loan modification Deed-in-lieu of foreclosure Short sale But before you go down any of those paths, it’s worth seeing if you have enough equity in your home to sell it and protect your investment. You May Be Able To Use Your Equity To Sell Your House Equity is the difference between what you owe on the home and its market value based on factors like price appreciation. In today’s real estate market, many homeowners have far more equity in their homes than they realize due to the home price appreciation we’ve seen over the past few years. According to CoreLogic: “The total average equity per borrower has now reached almost $300,000, the highest in the data series.” So, what does that mean for you? If you’ve lived in your house for at least a few years or more, chances are your home’s value, and your equity, has risen dramatically. In addition, the mortgage payments you’ve made during that time chipped away at the balance of your loan. If your home’s current value is higher than what you still owe on your loan, you may be able to use that increase to your advantage. Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains how equity can help: “Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.” Lean on Experts To Explore Your Options To find out how much equity you have, work with a local real estate professional. They can give you an estimate of what your house could sell for based on recent sales of similar homes in your area. You may be able to sell your house to avoid foreclosure. If you find out you have to pursue other options, your agent can help with that too. They’ll be able to connect you with other professionals in the industry, like housing counselors, who can look into your unique situation and offer advice on next steps if selling isn’t your best alternative. Bottom Line If you’re a homeowner facing hardship, let’s connect so you have an expert on your side to explore your options and see if you can sell your house to avoid foreclosure. Content previously posted on Keeping Current Matters

Read MoreVA Loans: Making Homes for the Brave Achievable

Some Highlights VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house. Homeownership is the American Dream. One way we can honor and thank our veterans is to ensure they have the best information about the benefits of VA home loans. Content previously posted on Keeping Current Matters

Read MoreVA Loans Can Help Veterans Achieve Their Dream of Homeownership

For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand this program and its benefits. Here are some things you should know about VA loans before you start the homebuying process. What Are VA Loans? VA home loans provide a pathway to homeownership for those who have served our nation. The U.S. Department of Veterans Affairs describes the program like this: “VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.” Top Benefits of the VA Home Loan Program In addition to helping eligible buyers achieve their homeownership dreams, VA loans have several other great benefits for buyers who qualify. According to the Department of Veteran Affairs: Qualified borrowers can often purchase a home with no down payment. Many other loans with down payments under 20% require Private Mortgage Insurance (PMI). VA Loans do not require PMI, which means veterans can save on their monthly housing costs. VA-Backed Loans often offer competitive terms and mortgage interest rates. A recent article from Veterans United sums up just how impactful this loan option can be: “For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.” John Bell, Acting Executive Director of the Department of Veterans Affairs Loan Guaranty Service, also explains why this program is so powerful: “It provides early ownership for many people that would not have that opportunity to begin with. Since there’s no down payment, it allows people to hold their wealth and it gives them the ability to have long term financial security by being able to own a house and let that equity grow.” Bottom Line Homeownership is the American Dream. Our veterans sacrifice so much in service of our nation, and one way we can honor and thank them is to ensure they have the best information about the benefits of VA home loans. Thank you for your service. Content previously posted on Keeping Current Matters

Read More-

Why Are People Moving Today? Buying a home is a major life decision. That’s true whether you’re purchasing for the first time or selling your house to fuel a move. And if you’re planning to buy a home, you might be hearing about today’s shifting market and wondering what it means for you. While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors. Instead, it’s necessary to consider why you want to move and how important those reasons are to you. Here are two of the biggest personal motivators driving people to buy homes today. A Need for More Space Moving.com looked at migration patterns to determine why people moved to specific areas. One trend that emerged was the need for additional space, both indoors and outdoors. Outgrowing your home isn’t new. If you’re craving a large yard, more entertaining room, or just need more storage areas or bedrooms overall, having the physical space you need for your desired lifestyle may be reason enough to make a change. A Desire To Be Closer to Loved Ones Moving and storage company United Van Lines surveys customers each year to get a better sense of why people move. The latest survey finds nearly 32% of people moved to be closer to loved ones. Another moving and storage company, Pods, also highlights this as a top motivator for why people move. They note that an increase in flexible work options has helped many homeowners make a move closer to the people they care about most: “. . . a shifting of priorities has also affected why people are moving. Many companies have moved to permanent remote working policies, giving employees the option to move freely around the country, and people are taking advantage of the perk.” If you can move to another location because of remote work, retirement, or for any other reason, you could leverage that flexibility to be closer to the most important people in your life. Being nearby for caregiving and being able to attend get-togethers and life milestones could be exactly what you’re looking for. What Does That Mean for You? If you’re thinking about moving, one of these reasons might be a top motivator for you. And while what’s happening with mortgage rates and home prices in the housing market today will likely play a role in your decision, it’s equally important to make sure your home meets your needs. Like Charlie Bilello, Founder and CEO of Compound Capital Advisors, says: “Your home is your castle and should confer benefits beyond just the numbers.” Bottom Line There are many reasons why people decide to move. No matter what the reason may be, if your needs have changed, let’s connect to discuss your options in today’s housing market.

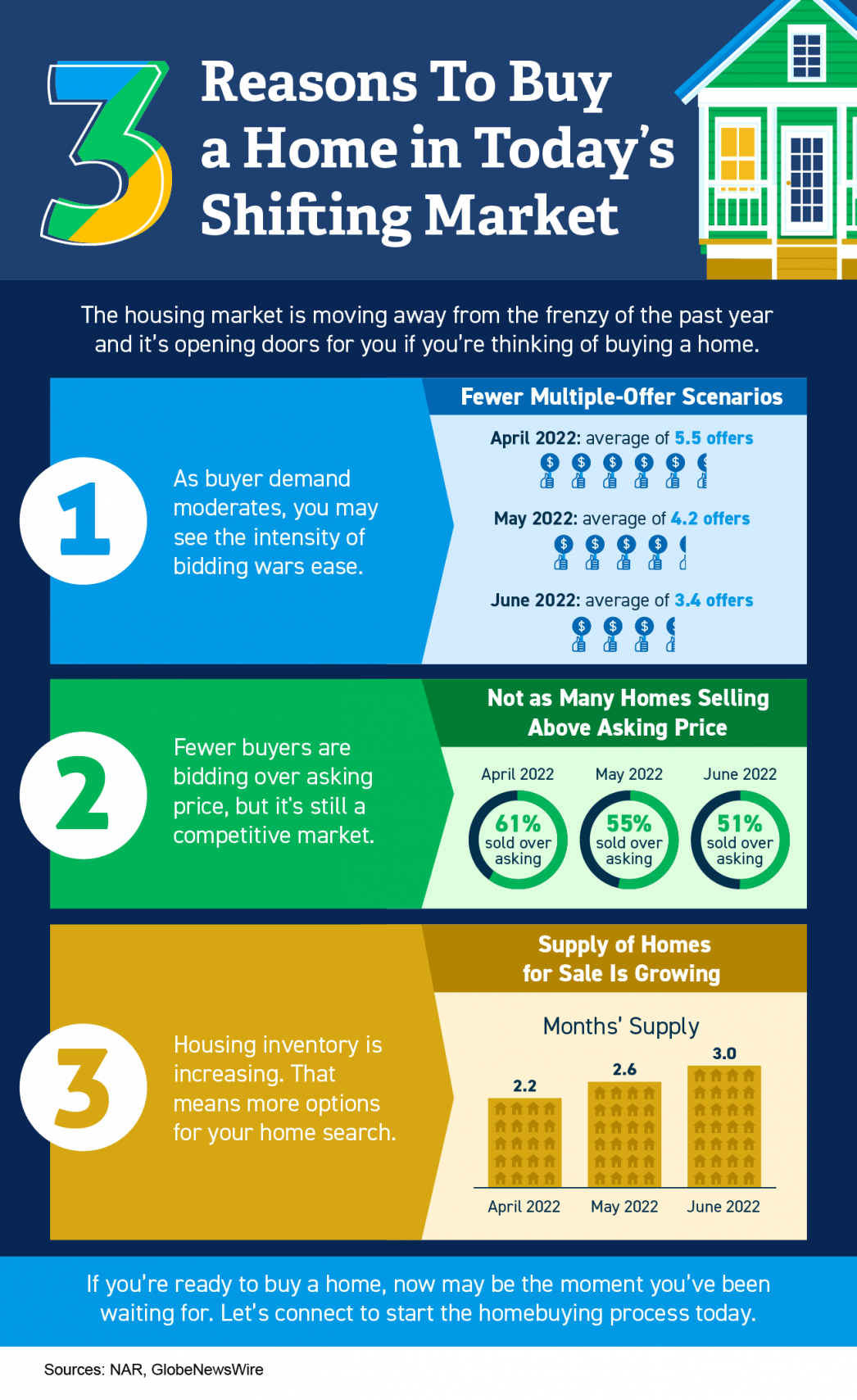

Read More Three Reasons To Buy a Home in Today’s Shifting Market

Three Reasons To Buy a Home in Today’s Shifting Market Some Highlights The housing market is moving away from the frenzy of the past year and it’s opening doors for you if you’re thinking about buying a home. Housing inventory is increasing, which means more options for your search. Plus, the intensity of bidding wars may ease as buyer demand moderates, leading to fewer homes selling above asking price. If you’re ready to buy a home, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today.

Read MoreA Real Estate Professional Helps You Separate Fact from Fiction

A Real Estate Professional Helps You Separate Fact from Fiction If you’re following the news, chances are you’ve seen or heard some headlines about the housing market that don’t give the full picture. The real estate market is shifting, and when that happens, it can be hard to separate fact from fiction. That’s where a trusted real estate professional comes in. They can help debunk the headlines so you can really understand today’s market and what it means for you. Here are three common housing market myths you might be hearing, along with the expert analysis that provides better context. Myth 1: Home Prices Are Going To Fall One piece of fiction many buyers may have seen or heard is that home prices are going to crash. That’s because headlines often use similar, but different, terms to describe what’s happening with prices. A few you might be seeing right now include: Appreciation, or an increase in home prices. Depreciation, or a decrease in home prices. And deceleration, which is an increase in home prices, but at a slower pace. The fact is, experts aren’t calling for a decrease in prices. Instead, they forecast appreciation will continue, just at a decelerated pace. That means home prices will continue rising and won’t fall. Selma Hepp, Deputy Chief Economist at CoreLogic, explains: “. . . higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.” Myth 2: The Housing Market Is in a Correction Another common myth is that the housing market is in a correction. Again, that’s not the case. Here’s why. According to Forbes: “A correction is a sustained decline in the value of a market index or the price of an individual asset. A correction is generally agreed to be a 10% to 20% drop in value from a recent peak.” As mentioned above, home prices are still appreciating, and experts project that will continue, just at a slower pace. That means the housing market isn’t in a correction because prices aren’t falling. It’s just moderating compared to the last two years, which were record-breaking in nearly every way. Myth 3: The Housing Market Is Going To Crash Some headlines are generating worry that the housing market is a bubble ready to burst. But experts say today is nothing like 2008. One of the reasons why is because lending standards are very different today. Logan Mohtashami, Lead Analyst for HousingWire, explains: “As recession talk becomes more prevalent, some people are concerned that mortgage credit lending will get much tighter. This typically happens in a recession, however, the notion that credit lending in America will collapse as it did from 2005 to 2008 couldn’t be more incorrect, as we haven’t had a credit boom in the period between 2008-2022.” During the last housing bubble, it was much easier to get a mortgage than it is today. Since then, lending standards have tightened significantly, and purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Bottom Line No matter what you’re hearing about the housing market, let’s connect. That way, you’ll have a knowledgeable authority on your side that knows the ins and outs of the market, including current trends, historical context, and so much more.

Read MoreWant To Buy a Home? Now May Be the Time.

Want To Buy a Home? Now May Be the Time. There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you: “This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession. . . They’ll have fewer buyers to compete with.” Two Reasons There Are More Homes for Sale The first reason the market is seeing more homes available for sale is the number of sales happening each month has decreased. This slowdown has been caused by rising mortgage rates and rising home prices, leading many to postpone or put off buying. The graph below uses data from realtor.com to show how active real estate listings have risen over the past four months as a result. The second reason the market is seeing more homes available for sale is because the number of people selling their homes is also rising. The graph below outlines new monthly listings coming onto the market compared to last year. As the graph shows, for the past three months, more people have put their homes on the market than the previous year. Bottom Line The number of homes for sale across the country is growing, and that means more options for those thinking about buying a home. This is the opportunity many have been waiting for who were outbid or out priced last year.

Read MoreA Window of Opportunity for Homebuyers

A Window of Opportunity for Homebuyers Mortgage rates are much higher today than they were at the beginning of the year, and that’s had a clear impact on the housing market. As a result, the market is seeing a shift back toward the range of pre-pandemic levels for buyer demand and home sales. But the transition back toward pre-pandemic levels isn’t a bad thing. In fact, the years leading up to the pandemic were some of the best the housing market has seen. That’s why, as the market undergoes this shift, it’s important to compare today not to the abnormal pandemic years, but to the most recent normal years to show how the current housing market is still strong. Higher Mortgage Rates Are Moderating the Housing Market The ShowingTime Showing Index tracks the traffic of home showings according to agents and brokers. It’s also a good indication of buyer demand over time. Here’s a look at their data going back to 2017 (see graph below): Here’s a breakdown of the story this data tells: The 2017 through early 2020 numbers (shown in gray) give a good baseline of pre-pandemic demand. The steady up and down trends seen in each of these years show typical seasonality in the market. The blue on the graph represents the pandemic years. The height of those blue bars indicates home showings skyrocketed during the pandemic. The most recent data (shown in green), indicates buyer demand is moderating back toward more pre-pandemic levels. This shows that buyer demand is coming down from levels seen over the past two years, and the frenzy in real estate is easing because of higher mortgage rates. For you, that means buying your next home should be less challenging than it would’ve been during the pandemic because there is more inventory available. Higher Mortgage Rates Slow the Once Frenzied Pace of Home Sales As mortgage rates started to rise this year, other shifts began to occur too. One additional example is the slowing pace of home sales. Using data from the National Association of Realtors (NAR), here’s a look at existing home sales going all the way back to 2017. Much like the previous graph, a similar trend emerges (see graph below): Again, the data paints a picture of the shift: The pre-pandemic years (shown in gray) establish a baseline of the number of existing home sales in more typical years. The pandemic years (shown in blue) exceeded the level of sales seen in previous years. That’s largely because low mortgage rates during that time spurred buyer demand and home sales to new heights. This year (shown in green), the market is feeling the impact of higher mortgage rates and that’s moderating buyer demand (and by extension home sales). That’s why the expectation for home sales this year is closer to what the market saw in 2018-2019. Why Is All of This Good News for You? Both of those factors have opened up a window of opportunity for homeowners looking to move and for buyers looking to purchase a home. As demand moderates and the pace of home sales slows, housing inventory is able to grow – and that gives you more options for your home search. So don’t let the headlines about the market cooling or moderating scare you. The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic – and that’s a good thing. It opens up new opportunities for you to find a home that meets your needs. Bottom Line The housing market is undergoing a shift because of higher mortgage rates, but the market is still strong. If you’ve been looking to buy a home over the last couple of years and it felt impossible to do, now may be your opportunity. Buying a home right now isn’t easy, but there is more opportunity for those who are looking.

Read MoreWhat’s Causing Ongoing Home Price Appreciation?

What’s Causing Ongoing Home Price Appreciation? If you’re thinking about making a move, you probably want to know what’s going to happen to home prices for the rest of the year. While experts say price growth will moderate due to the shifting market, ongoing appreciation is expected. That means home prices won’t fall. Here’s a look at two key reasons experts forecast continued price growth: supply and demand. While Growing, Housing Supply Is Still Low Even though inventory is increasing this year as the market moderates, supply is still low. The graph below helps tell the story of why there still aren’t enough homes on the market today. It uses data from the Census to show the number of single-family homes that were built in this country going all the way back to the 1970s. The blue bars represent the years leading up to the housing crisis in 2008. As the graph shows, right before the crash, homebuilding increased significantly. That’s because buyer demand was so high due to loose lending standards that enabled more people to qualify for a home loan. The resulting oversupply of homes for sale led to prices dropping during the crash and some builders leaving the industry or closing their businesses – and that led to a long period of underbuilding of new homes. And even as more new homes are constructed this year and in the years ahead, this isn’t something that can be resolved overnight. It’ll take time to build enough homes to meet the deficit of underbuilding that took place over the past 14 years. Millennials Will Create Sustained Buyer Demand Moving Forward The frenzy the market saw during the pandemic is because there was more demand than homes for sale. That drove home prices up as buyers competed with one another for available homes. And while buyer demand has moderated today in response to higher mortgage rates, data tells us demand will continue to be driven by the large generation of millennials aging into their peak homebuying years (see graph below): Odeta Kushi, Deputy Chief Economist at First American, explains: “. . . millennials continue to transition to their prime home-buying age and will remain the driving force in potential homeownership demand in the years ahead.” That combination of millennial demand and low housing supply continues to put upward pressure on home prices. As Bankrate says: “After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.” What This Means for Home Prices If you’re worried home values will fall, rest assured that experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand. That means home prices won’t decline. Bottom Line Based on today’s factors driving supply and demand, experts project home price appreciation will continue. It’ll just happen at a more moderate pace as the housing market continues its shift back toward pre-pandemic levels.

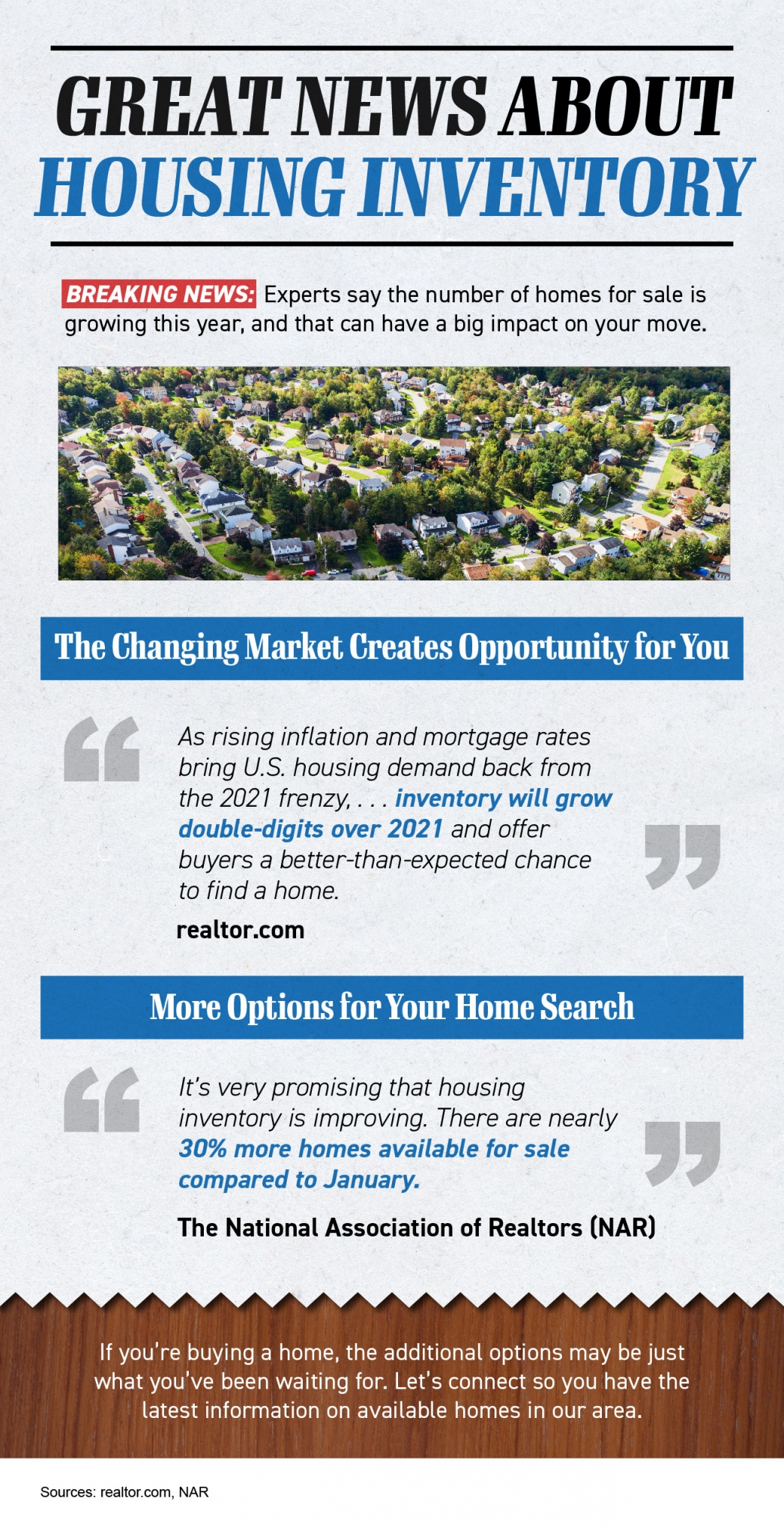

Read MoreGreat News About Housing Inventory

Great News About Housing Inventory Some Highlights Experts say the number of homes for sale is growing this year, and that can have a big impact on your move. If you’re planning to buy, additional options in today’s market may be just what you’ve been waiting for. More inventory means added opportunities to find the home of your dreams. Let’s connect so you have the latest information on available homes in our area.

Read More

Categories

Recent Posts